- #Make invoices for mac manual#

- #Make invoices for mac verification#

- #Make invoices for mac software#

#Make invoices for mac software#

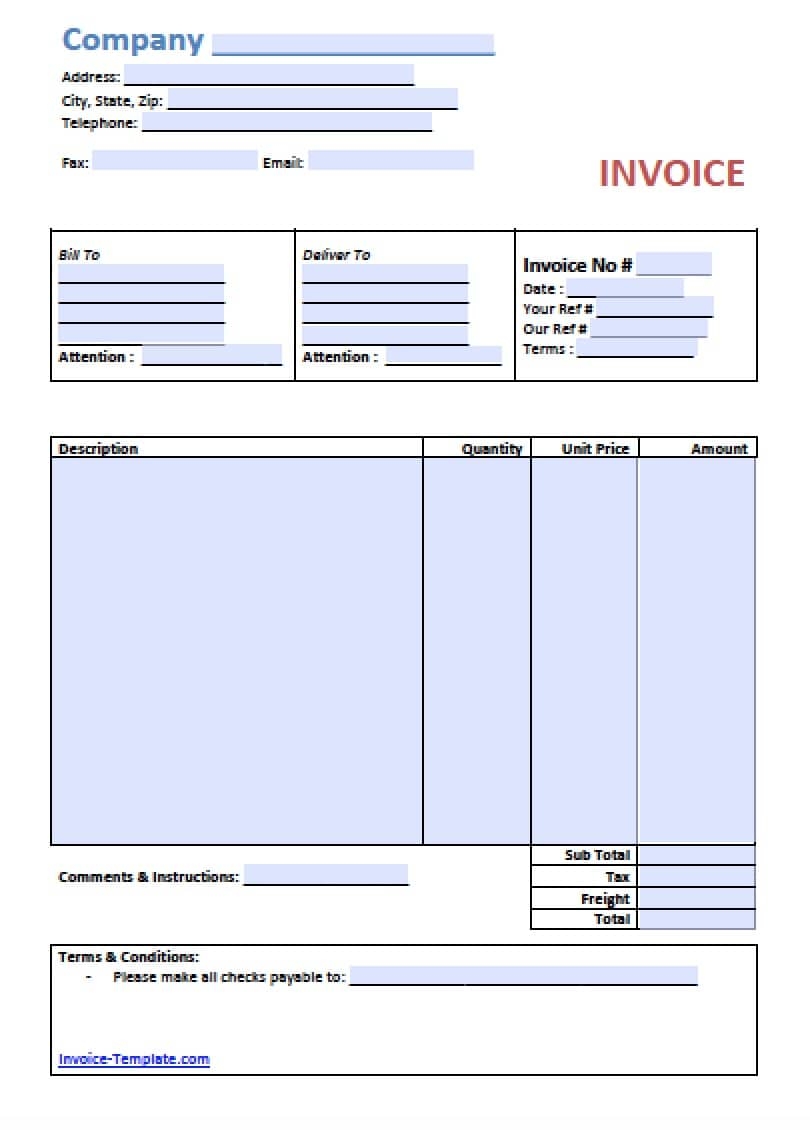

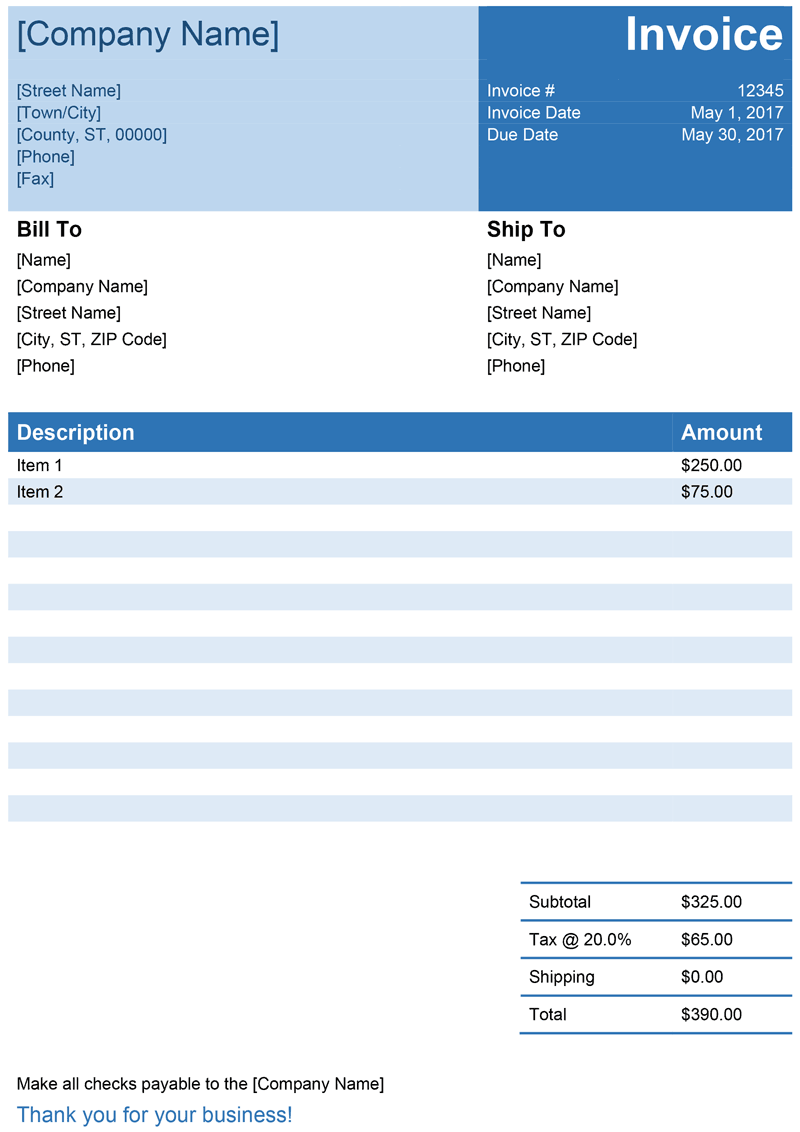

Having accounting software that is compatible with Mac can provide many benefits for small business owners. Also, consider the level of support, pricing, and security that the software provides. When evaluating the best invoice and billing software for MacBook, prioritize the features that are most important to your business needs. Check the company’s reputation and its history of providing reliable and effective software solutions. Look for customer reviews and ratings of the accounting software to see what others have experienced. Consider any hidden fees, such as transaction or support charges, that may affect your overall cost. The software should be priced fairly, with transparent pricing plans that match the features and level of support you require. It should offer email and phone support and preferably a knowledge base or FAQs to help you troubleshoot issues on your own. The accounting software should offer responsive and helpful customer support, with multiple channels available for contacting support staff. The software should have strong security measures to protect your data and financial transactions from potential breaches or fraud. It must integrate seamlessly with other tools you use, such as accounting software and payment gateways. The software should be compatible with your MacBook operating system and hardware. It should be able to create customized invoices, track expenses, and payments, automate billing and payment processing, and generate financial reports. The software should offer a range of features that meet your specific business needs. The accounting software you choose must have intuitive features that allow you to quickly generate invoices and manage billing. The user interface should be easy to navigate and use. When evaluating Best Invoice And Billing Software For MacBook, here are some key criteria to consider: User Interface: Invoice and billing software is essential for any business that wants to stay organized, efficient, and financially healthy.

It can improve overall business operations. Many invoice and billing software solutions offer powerful reporting and data analysis tools that can help businesses to gain valuable insights into their financial performance. It builds customer trust and loyalty, which can lead to repeat business and positive word-of-mouth referrals. The software ensures that invoices are accurate and delivered promptly. Improved Customer Service:īy using invoicing software to manage billing and invoicing, businesses can provide better customer service. It can help improve cash flow and reduce the risk of late payments. Many invoice and billing software solutions offer automated payment processing, which means that businesses can receive payments faster and more efficiently. It helps avoid customer disputes and ensures that payments are received on time. Invoice and billing software can greatly reduce the chances of errors or mistakes in the billing process. It allows businesses to focus on other essential activities and helps them to be more productive. Using business accounting software to create invoices can considerably reduce the time and effort required to execute these operations. It saves you time because you don’t have to manually fill out any invoices.

#Make invoices for mac manual#

You can avoid all the manual labour and seamlessly manage your billing process. The invoice and billing software can help you create bills in less than a minute. Here are some of the key reasons why they are important: Generate Invoices Quickly: Deposit times may vary due to processing cutoff times or third party delays.Invoice and billing software are crucial tools for any business that wants to maintain accurate financial records and streamline its billing process. Deposits are sent to the debit card linked to your account in up to 30 minutes. A 1% fee is applied to the amount you withdraw from your available balance, in addition to regular processing fees. Instant Payout is an additional service offered by Wave subject to user and payment eligibility criteria. In some cases, we may hold funds and request more information if we need it for the protection of your business and Wave's. All payments are subject to a risk review and periodic credit risk assessments are done on business owners because we need to cover our butts (and yours). Payments are a pay-per-use feature no monthly fees here! Your deposit times may vary based on your financial institution.

#Make invoices for mac verification#

A few notes about accepting online payments through Wave:Īpproval is subject to eligibility criteria, including identity verification and credit review. Deposit times may vary due to processing cutoff times, third party delays, or risk reviews.

1 Payouts are processed in 1-2 business days for credit card payments and 1-7 business days for bank payments.

0 kommentar(er)

0 kommentar(er)